A Love Letter to the Beating Heart: Why 2026 is the Year of the "Business Widowmaker"

A love letter to the beating heart: why 2026 is the year of the "business widowmaker"

Seventeen years. That is how much time the road steals from a long-haul trucker's life expectancy compared to the average American. It is a brutal statistic, but one that every owner-operator knows in their bones. The heart isn't just a symbol of romance this February. As Darcey Steinke wrote in the New York Times yesterday, "it's the organ that guards the line between life and death."

But for the 2026 tax season, the "widowmaker" isn't just a medical term. It is administrative.

While you were watching the road, the IRS issued Revenue Procedure 2025-10. This is the first major overhaul of independent contractor rules in 40 years. This new guidance, paired with the aggressive enforcement of Beneficial Ownership Information (BOI) penalties, has created a regulatory environment that threatens to stop the beating heart of your business: your cash flow.

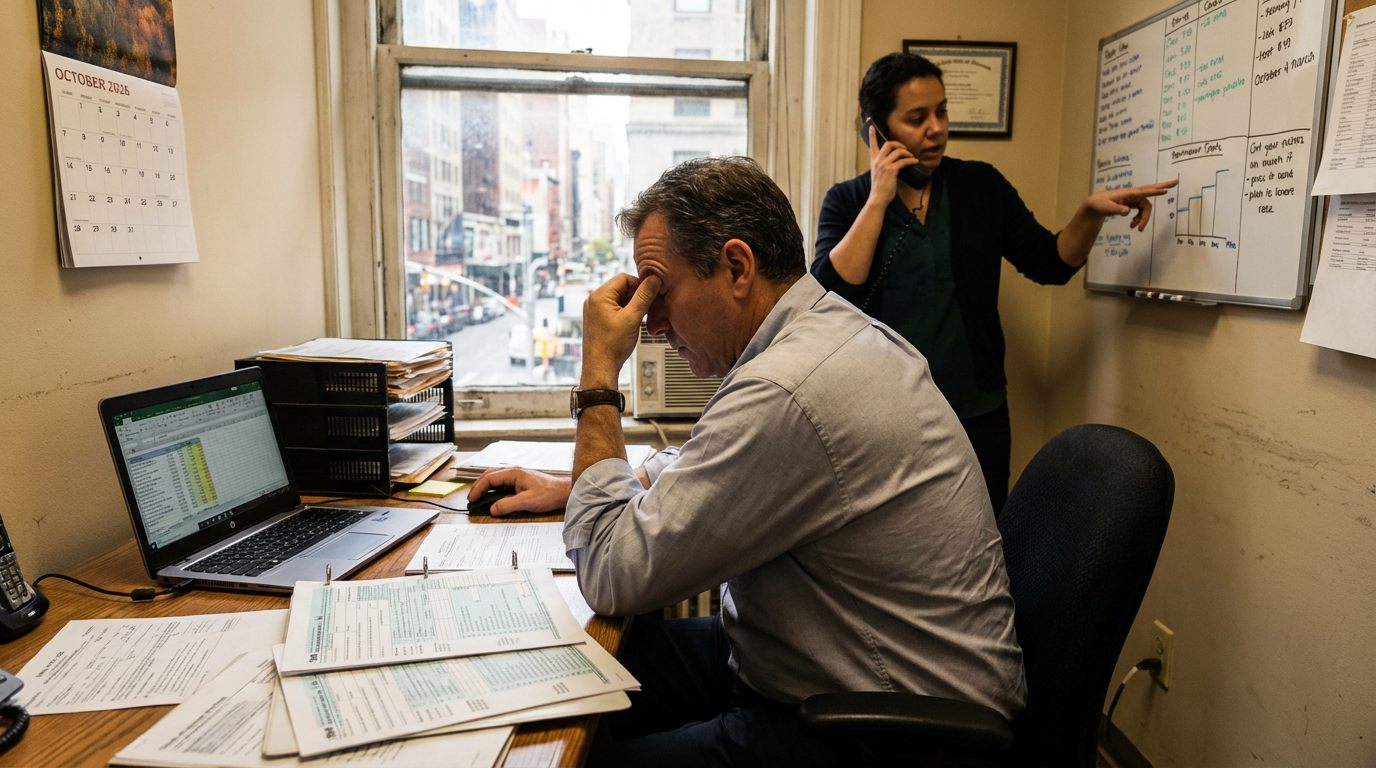

This is a love letter to that heart. It is a plea to treat your business's arteries—your tax filings and legal structures—with the same urgency as your physical health. This year, a "wait and see" approach is a mistake you cannot afford.

The essentials for the 2026 tax season

- The "safe harbor" is shrinking. Revenue Procedure 2025-10 makes it much harder to defend independent contractor status if you have been inconsistent in any paperwork (IRS, 2025).

- BOI penalties are active. If your LLC existed before 2024 and you missed the Jan 1, 2025 deadline, you face potential civil penalties of up to $591 per day (adjusted for inflation) (FinCEN, 2025).

- Mileage rate bump. The standard mileage deduction for 2025 returns (filed now) is 70 cents per mile—up 3 cents from last year (IRS Notice 2025-01).

- Depreciation cliff. 100% Bonus Depreciation is gone. For 2025 returns, it has phased down to 40%, which slashes write-offs for new equipment.

The organ that guards the line

Let's look at the physical reality first. According to 2025 data from Realm Health and the CDC, truck drivers face a 50% higher risk of heart disease than the general population. The job is sedentary, stressful, and fueled by whatever is available at the next exit. In fact, 80% of independent truckers now manage at least one serious health condition, whether that is hypertension, diabetes, or obesity (CDC/NIOSH, 2025).

Your truck's engine gets a preventive overhaul every few hundred thousand miles. Your body likely gets less attention. But the connection between physical health and business health is literal: if you lose your medical certification, the business stops. There is no backup generator for the driver.

Just as plaque builds up silently in arteries, non-compliance builds up in a business. You don't feel it until the flow stops. Right now, the IRS has introduced a new blockage.

Revenue Procedure 2025-10: the new artery block

For decades, businesses relied on "Section 530 Safe Harbor" relief. This was the rule that basically said: "If I treated this worker as a contractor reasonably and consistently, the IRS won't reclassify them as an employee and hit me with back taxes."

That protection just got thinner.

On January 17, 2025, the IRS released Revenue Procedure 2025-10. It is the first significant update to this relief in four decades. The most dangerous change is the focus on Substantive Consistency.

Substantive Consistency — A new IRS standard requiring that a worker must not only be treated as a contractor for tax purposes but also for all ancillary legal and benefits purposes to qualify for Safe Harbor relief.

According to legal analysis by Littler Mendelson P.C. (2025), the IRS can now deny Safe Harbor relief if a worker was treated as an employee for any non-tax purpose. Did you file a state workers' compensation claim listing them as an employee? Did you fill out a credit application calling them an employee? Under the new guidance, that single inconsistency can shatter your federal tax defense.

As Sarah Jenkins, Senior Tax Policy Analyst at the National Association of Tax Professionals (NATP), warned recently: "If audited, today's actions... influence tomorrow's decisions, as Rev. Proc. 2025-10 is the cornerstone of your ability to have 'relief' from employment tax collection."

If you are a fleet owner paying drivers, or a gig worker hiring subs, your paperwork must be flawless. The "I didn't know" defense is dead.

The $591 daily hemorrhage: missed BOI deadlines

While the IRS tightens the screws on contractors, the Financial Crimes Enforcement Network (FinCEN) is hunting for missing reports. The Corporate Transparency Act required all existing companies (formed before 2024) to file a Beneficial Ownership Information (BOI) report by January 1, 2025.

Beneficial Ownership Information (BOI) — A mandatory federal filing that identifies the individuals who directly or indirectly control at least 25% of a company or exercise substantial control over it.

That deadline passed six weeks ago.

If you own an LLC, S-Corp, or Inc. and haven't filed this report, you are currently in non-compliance. The civil penalty is set at $500 but inflation-adjusted to $591 for each day the violation continues (FinCEN, 2025). This isn't a tax; it is a transparency requirement designed to catch shell companies. But legitimate trucking companies and gig worker LLCs are getting caught in the net.

Many DIY tax software packages do not file this for you. It is a separate filing. If you assumed your annual state registration covered this, you are mistaken. At USTAXX, checking BOI compliance is now step one of our review process because stopping a $591-a-day bleed is more important than finding a $50 deduction.

70 cents and 40 percent: the new math of survival

When we look at the 2025 tax returns we are filing right now, the math has shifted. You need to adjust your expectations for your refund or liability. Here is the snapshot of the changes hitting your return:

2024 vs. 2025 tax year comparison

| Item | 2024 Tax Year (Filed Last Year) | 2025 Tax Year (Filed Now) | Impact | | :--- | :--- | :--- | :--- | | Standard Mileage Rate | 67 cents/mile | 70 cents/mile | +$1,200 deduction on 40k miles | | Bonus Depreciation | 60% of purchase price | 40% of purchase price | Massive reduction in upfront write-offs | | Safe Harbor Rules | Loose interpretation | Strict "Substantive Consistency" | Higher audit risk for contractors | | BOI Filing | Voluntary/Pending | Mandatory (Overdue) | $591/day penalty risk |

The good news: 70 cents per mile For the 2025 tax year, the IRS raised the Standard Mileage Rate to 70 cents per mile. For a rideshare driver covering 40,000 miles, that's a $28,000 deduction—an extra $1,200 reduction in taxable income compared to the previous year. As Phong Nguyen, CEO of Motus, noted in January, "It's essential for business leaders to support their employees who drive," and for self-employed drivers, this deduction is your lifeline.

The bad news: 40% bonus depreciation The era of buying a truck and writing off 100% of the cost in year one is over. The Tax Cuts and Jobs Act phase-down has hit hard. For 2025 returns, Bonus Depreciation is limited to 40%.

- Scenario: You bought a $150,000 rig in 2025.

- 2022 Return: You could deduct $150,000 immediately.

- 2025 Return (Filed Now): You can deduct only $60,000 immediately (plus regular depreciation on the remainder).

This reduction in upfront write-offs means many owner-operators will show a higher taxable profit this year, even if they spent the same amount on equipment. This catches people off guard. You need a tax strategy that anticipates this bill, not one that looks backward at rules that no longer exist.

Diagnosing the problem: DIY vs. specialist care

You wouldn't let a general mechanic overhaul your diesel transmission. You go to a specialist. Yet thousands of gig workers and truckers use generic box software to file taxes that involve complex depreciation schedules and multi-state nexus issues.

Employment tax noncompliance accounts for approximately $119 billion of the federal tax gap, according to a 2025 IRS report. That number is why auditors are aggressive. When you use DIY software, you are often clicking "yes" or "no" on questions designed for W-2 office workers, not independent contractors navigating Per Diem rates and fuel surcharges.

At USTAXX, we serve the drivers and entrepreneurs who keep the economy moving. We speak your language—literally (offering support in Russian, Turkish, Spanish, and more) and figuratively. We understand that a "beating heart" isn't just a metaphor. It is the engine idling in the lot, the blood pumping through your veins, and the cash flow that keeps your family fed. Do not let a paperwork clot stop it.

Frequently asked questions

1. Can I still file my BOI report if I missed the January 1, 2025 deadline? Yes, immediately. While the statutory penalty can reach $591 per day (adjusted for inflation), FinCEN has indicated they prioritize willful non-compliance (FinCEN, 2025). Filing late is much better than not filing at all. USTAXX can handle this submission to ensure it is done correctly and document your intent to comply.

2. How does the 2025 mileage rate increase affect my tax refund? The rate is 70 cents per mile for 2025. If you drove 50,000 miles for business, your deduction is $35,000—an increase of $1,500 compared to the 2024 rate. This directly lowers your taxable income. However, you must have a compliant mileage log (like an ELD report or app record) to survive an audit.

3. What is the "substantive consistency" rule in Rev. Proc. 2025-10? Substantive Consistency is the new IRS standard requiring that you treat a worker as a contractor for all purposes, not just taxes. If you list a driver as an employee on a credit application or insurance form, you lose the "Safe Harbor" protection (IRS, 2025). This creates a direct path for the IRS to reclassify them and demand back taxes.

4. Is it better to claim actual expenses or the standard mileage rate for a delivery van? It depends on vehicle efficiency. With the rate at 70 cents, smaller, fuel-efficient vehicles often benefit more from the standard rate. Heavy trucks with high maintenance and fuel costs often benefit from actual expenses. We run both calculations for every USTAXX client to see which method yields the lowest legal tax liability.

Need Help With Your Taxes?

Our IRS-authorized team specializes in trucking, LLC, and small business tax preparation. Get expert help today.

Get Started